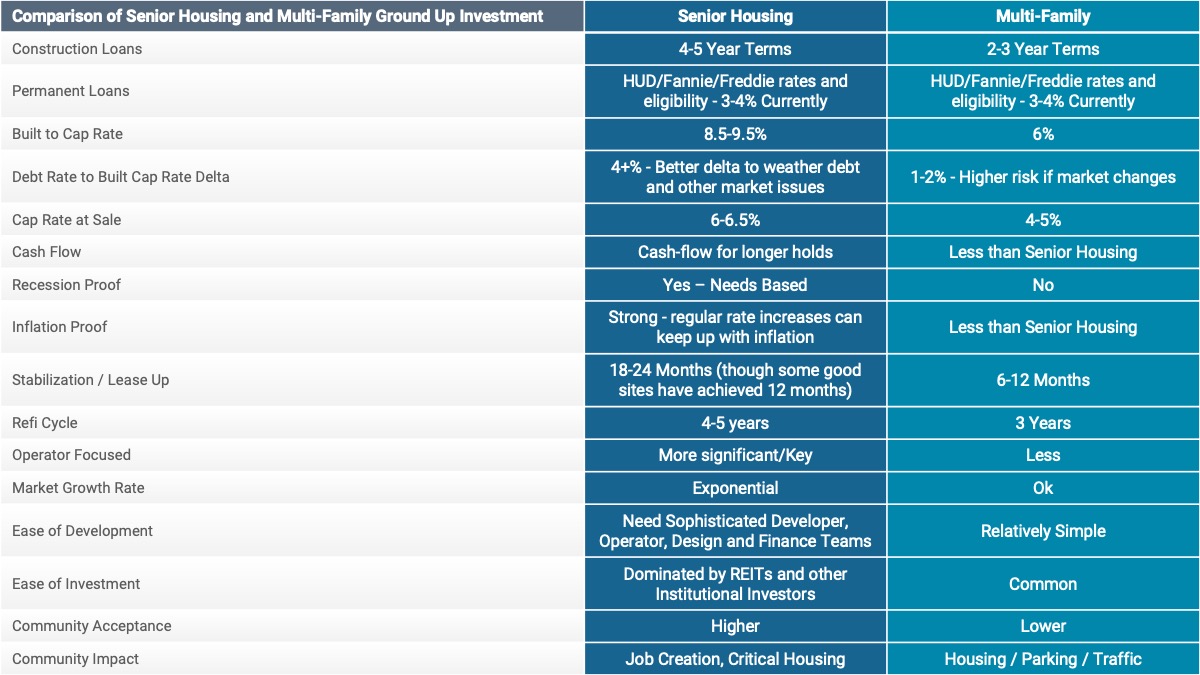

Senior housing is less commonly understood than other forms of Real Estate, but may be an ideal investment or compliment to a more common Multi-family portfolio.

Seniors Care ground up investments in many ways can be better performing than multi-family ground up investments. In particular we are comparing a typical Assisted Living/Memory Care (AL/MC) ground up project with a similar sized Multi-Family Apartment ground up project.

Financial Performance

- Generally Senior Care Projects have performed better in terms of NOI and IRR than similar sized apartment projects.* While the NOI is lower due to higher operating costs (typically in the 35-40% range) the overall gross NOI and cash flow is higher based on the packages of services provided and the related revenue streams.

Risk Management

- Senior Care projects are generally considered recession resistant because they are a needs based type of housing and historically have not been as impacted by recessions as market rate housing. They are also generally built at a higher cap on cost (8.5-9.5% and higher) than typical multi-family (6%), but still enjoy access to low Fanny Mae/Freddy Mac/HUD long term financing, so they are better protected against increased debt rates. They are also more inflation proof as they tend to have more consistent rate increases that can keep up with or surpass inflation rates.

Market Growth Potential

- The senior age cohorts 65 and greater are growing at a much faster pace, particularly in the next ten years, based on the baby boomers reaching these ages than the general population and market for multi-family. This silver tsunami is just starting to hit the market.* http://www.realestateinvestormagazines.com/invest-senior-living/

Debt Rate to Cap on Cost

- Investing in Seniors Projects can allow the investor to take advantage of the much greater spread between the cap on cost and cost of debt typical of seniors projects than typical multi-family projects.

There are a few other key differences between seniors and multi-family that an investor should consider. The lease up for seniors is longer that multi-family. A typical seniors project can achieve stabilization in 18-24 months as lease up is a little longer. A typical multi-family project may stabilize in 6-12 months. This makes the minimum hold a little longer for seniors and delays a potential capital event with a refinance for seniors. Another aspect that is different for seniors projects is the importance of the operator. Since there are a lot of operational revenue streams and a significant operations component to a successful project the selection of the operator is much more important for a seniors project. Having an experienced and capable operator is extremely important for Senior Care projects.

Silver Tsunami *http://www.realestateinvestormagazines.com/invest-senior-living/